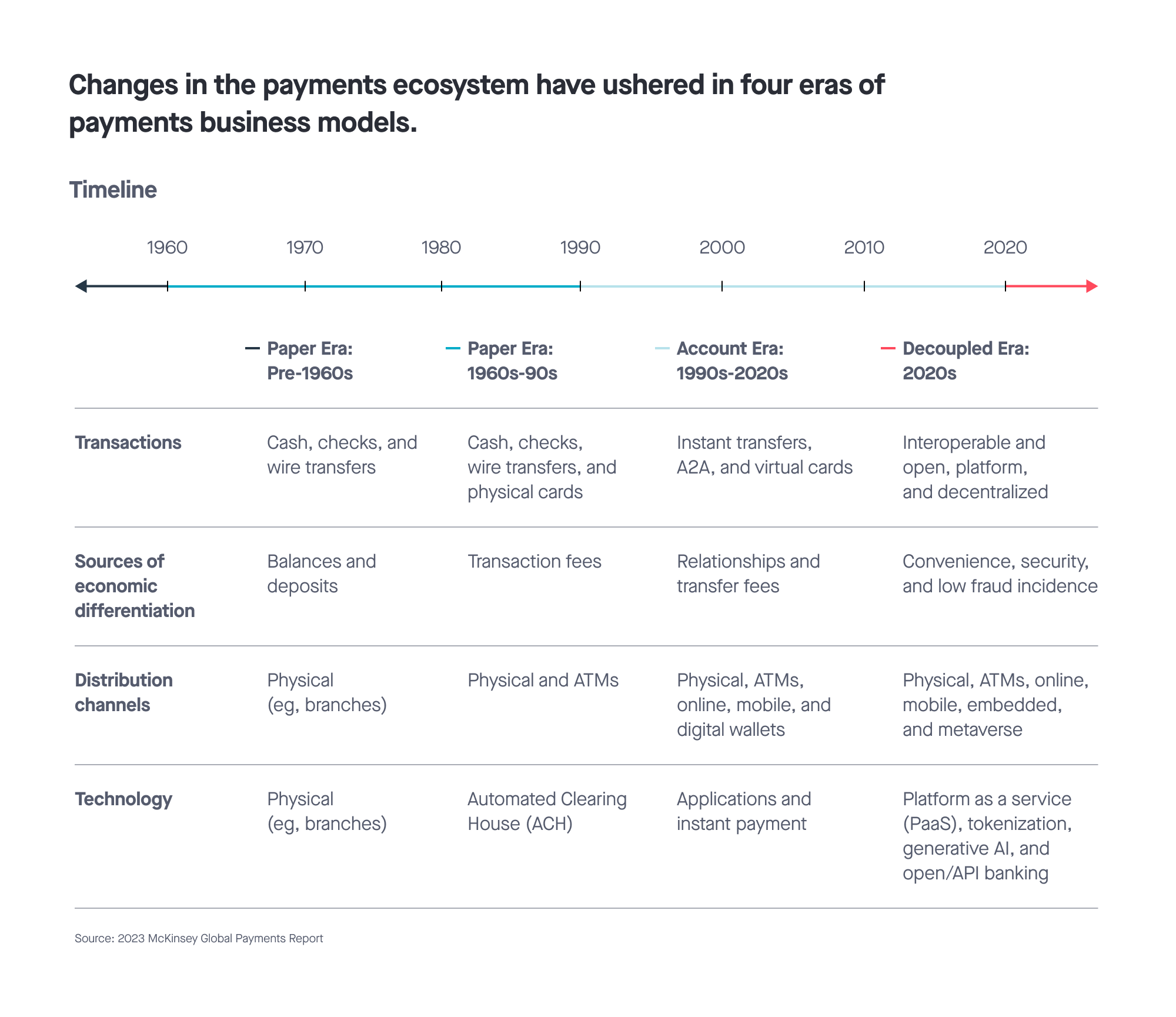

Digital payments are swiftly transitioning from a good-to-have to becoming the de facto standard in the asset finance industry – a shift propelled by customers’ demands for simplicity and convenience and a global governmental push towards embracing digital economies.

A 2023 McKinsey Global Payments Report * highlights that over the past five years, the volume of worldwide electronic payments transactions has grown significantly faster (17%) than payments revenue (6%). In the Single Euro Payments Area (SEPA), instant payments currently represent 12% of the credit transfer volume, with projections suggesting this could double by 2027 even without regulatory intervention. With anticipated regulatory changes, their share could escalate to 45% of SEPA's 23 billion annual transactions. Even the U.S. launched the Federal Reserve’s FedNow real-time payment system in July 2023 to cater to the increasing demand for digital payment options for consumers.

The journey towards this digital transformation has been significantly smoothed by the advent of Application Programming Interfaces (APIs). Asset finance companies are now at the point where adopting an API-first mindset is crucial for crafting innovative solutions (To know more, read our latest white paper: Banking on APIs: The Asset Finance Edition).

APIs enable smooth integration between different financial systems and platforms facilitating customization and expansion of payment services to meet evolving business and customer needs. Let’s understand the primary factors leading to the widespread adoption of digital payments as the industry standard and discuss how asset finance companies can ready themselves for this shift.

Factors driving the widespread adoption of digital payments

The adoption of digital payment methods is transforming the financial landscape, driven by various key factors that collectively create a robust ecosystem for their growth and acceptance.

Demographics and consumer behavior

- Demographics and consumer behavior: The demographic landscape, particularly in emerging markets, is pivotal in shaping the trajectory of digital payments. With a burgeoning youth population, these markets represent a "sweet spot" where the demand for online transactions is poised to skyrocket. As digital literacy proliferates and smartphone penetration reaches new heights, the transition towards digital payments becomes inevitable.

Moreover, the rise of subscription-based services underscores the growing need for digital payment capabilities. For instance, subscription-based asset financing models for equipment or vehicles necessitate robust digital payment infrastructures to facilitate recurring payments efficiently.

Financial inclusion and technological innovation

- Financial inclusion and technological innovation: Financial inclusion lies at the heart of the digital payment revolution, driving innovation and technological advancements. Mobile money platforms pioneered in regions with limited access to traditional banking services have emerged as a game-changer, providing financial services to millions of individuals previously excluded from the formal banking sector. Moreover, the FinTech revolution, characterized by the proliferation of innovative payment solutions and non-bank players, has democratized access to financial services, catalyzing the adoption of digital payments on a global scale.

Regulatory initiatives and infrastructure development

- Regulatory initiatives and infrastructure development: Governments worldwide are playing a pivotal role in shaping the digital payments landscape through regulatory frameworks and infrastructure development initiatives. In Europe, regulatory mandates such as the Payment Services Directive 2 (PSD2) have propelled the adoption of open banking and standardized payment systems, fostering competition and innovation within the financial sector. Similarly, in India, the Unified Payments Interface (UPI) has revolutionized digital payments, enabling frictionless peer-to-peer and merchant transactions through a single platform. Moreover, the promotion of card acceptance infrastructure and the expansion of electronic payment networks have accelerated the transition towards a cashless economy in emerging markets.

The momentum towards digital payments is an inevitable shift and not overly complex. With the right technology and provider, companies can enable digital payments swiftly, opening new avenues for business growth and consumer convenience. The move towards digital payments represents a significant leap forward in financial technology, making it easier for businesses to meet the evolving needs of consumers worldwide.

An API-first strategy facilitates digital payments

At the heart of this integration effort is the strategic use of APIs, which are crucial for ensuring smooth interactions across diverse systems and platforms. These APIs act as the backbone of the digital payment infrastructure, enabling efficient data exchange, transaction processing, and real-time reporting. They establish an orchestration layer that offers a unified gateway to a variety of service providers, including processors and acquirers, through a singular interface. This orchestration layer not only simplifies integrations on both the front-end and back-end, whether online or physical, but also allows for managing a range of functions via a single unified platform.

These APIs, or Payment Orchestration Platforms (POPs), enhance operational efficiency by consolidating multiple Payment Service Providers (PSPs) and the extensive array of payment methods they support.

Along with adopting an API-first approach, companies must also ensure automation of critical business operations such as billing, invoicing, and collections, which are essential for enabling smooth digital transactions.

Automation brings the advantage of real-time invoicing and billing, ensuring timely and accurate payment requests to customers. An automated collections process aids in optimizing cash flow by effectively monitoring and managing pending payments. Furthermore, it boosts data accuracy and compliance by removing the dependence on manual methods. Through the adoption of comprehensive software solutions like end-to-end asset management platforms, companies can achieve the necessary automation to streamline these processes, thus minimizing manual errors and processing times.

Lastly, investing in customer-friendly, self-service platforms is equally important, as it provides users with easy-to-navigate interfaces for initiating and managing digital payments effortlessly.

Best practices for implementing digital payments

To maximize their investment in payment acceptance, companies must adopt a cross-functional approach and collaborate with digital, marketing, and technology teams within their organizations. This strategy transforms payment acceptance from a business cost into a driver of strategic growth, aligning it with company objectives.

Here are the essential considerations and best practices asset finance companies should keep in mind to ensure a smooth transition to digital payment systems:

An API-first asset management platform

- An API-first asset management platform:

In a digitally interconnected world, the efficacy of digital payment systems hinges on the interoperability of APIs. Asset finance companies must prioritize the adoption of robust API solutions that facilitate integration with third-party platforms and systems.

By standardizing APIs and adhering to industry best practices, you can ensure interoperability, scalability, and security across the digital payment ecosystem. This enables integration with digital payment platforms, resulting in swift reconciliation and settlement of transactions. Not only does this enhance operational efficiency, but it also significantly improves the customer experience by providing faster and more reliable payment processing.

Digital self-service platforms

- Digital self-service platforms:The modern finance landscape places a premium on customer-centricity and convenience. You can significantly enhance customer experiences by offering intuitive self-service platforms. These platforms empower customers to initiate and manage digital payments autonomously, serving as centralized hubs for accessing account information, processing payments, and resolving inquiries. By streamlining interactions, these platforms promote customer loyalty and satisfaction.

Data-driven insights

- Data-driven insights: Examine your payment process from start to finish. By understanding the journey of data from purchase to settlement and integration into your back-office accounting systems, you can create streamlined processes that simplify information handling. This optimization facilitates quicker reporting and expedites fund recognition.

Security

- Security: As custodians of sensitive financial data, asset finance companies must prioritize security in all facets of their digital payment operations. Implementing robust security measures, such as transaction encryption, identity verification, and multi-factor authentication, is paramount to safeguarding customer information and mitigating risks associated with fraud. Employing encryption protocols and proactive monitoring systems instills trust and confidence in the digital payment infrastructure, ensuring the protection of both company and customer data.

Simplifying adoption with tech

With the right approach and solutions, implementing digital payments should be straightforward. For companies that find themselves lacking in-house development skills, the solution lies in partnering with a technology provider and selecting asset finance management software equipped with robust APIs and integration capabilities.

As an asset finance leader, you need to choose a technology partner that offers a strategic approach through an API-first, end-to-end asset finance platform, standard industry integrations, advanced development capabilities, and robust secure APIs, simplifying the adoption of digital payments.

By focusing on these key practices, asset finance companies can navigate the complexities of digital payments, ensuring a secure, efficient, and customer-centric payment ecosystem.

Sources:

Learn why companies trust Odessa to help deliver great stakeholder experiences.

Let’s Talk