At the recently concluded 62nd ELFA Annual Convention, various sessions and casual conversations around AI unfolded a rich tapestry of possibilities -- ways in which companies can leverage AI to transform every aspect of an asset finance and leasing business.

It was during a casual conversation that a fellow attendee shared an intriguing perspective on AI, saying, "AI is going to augment everything that we do -- every day. From that perspective, it should be called augmented and not artificial intelligence."

I’m not sure if it was an original thought or if my fellow attendee was quoting someone else -- but the thought stuck with me.

Indeed, AI has the potential to revolutionize how asset finance companies operate. The question remains: if it’s so beneficial, why are we not witnessing an explosion of AI-enabled use cases in the industry?

To AI or not to AI

The buzz at the event, from keynotes to discussions, centered around AI. Yet, there's a noticeable gap between recognizing AI's impact and having clear strategies for successful implementation within organizations.

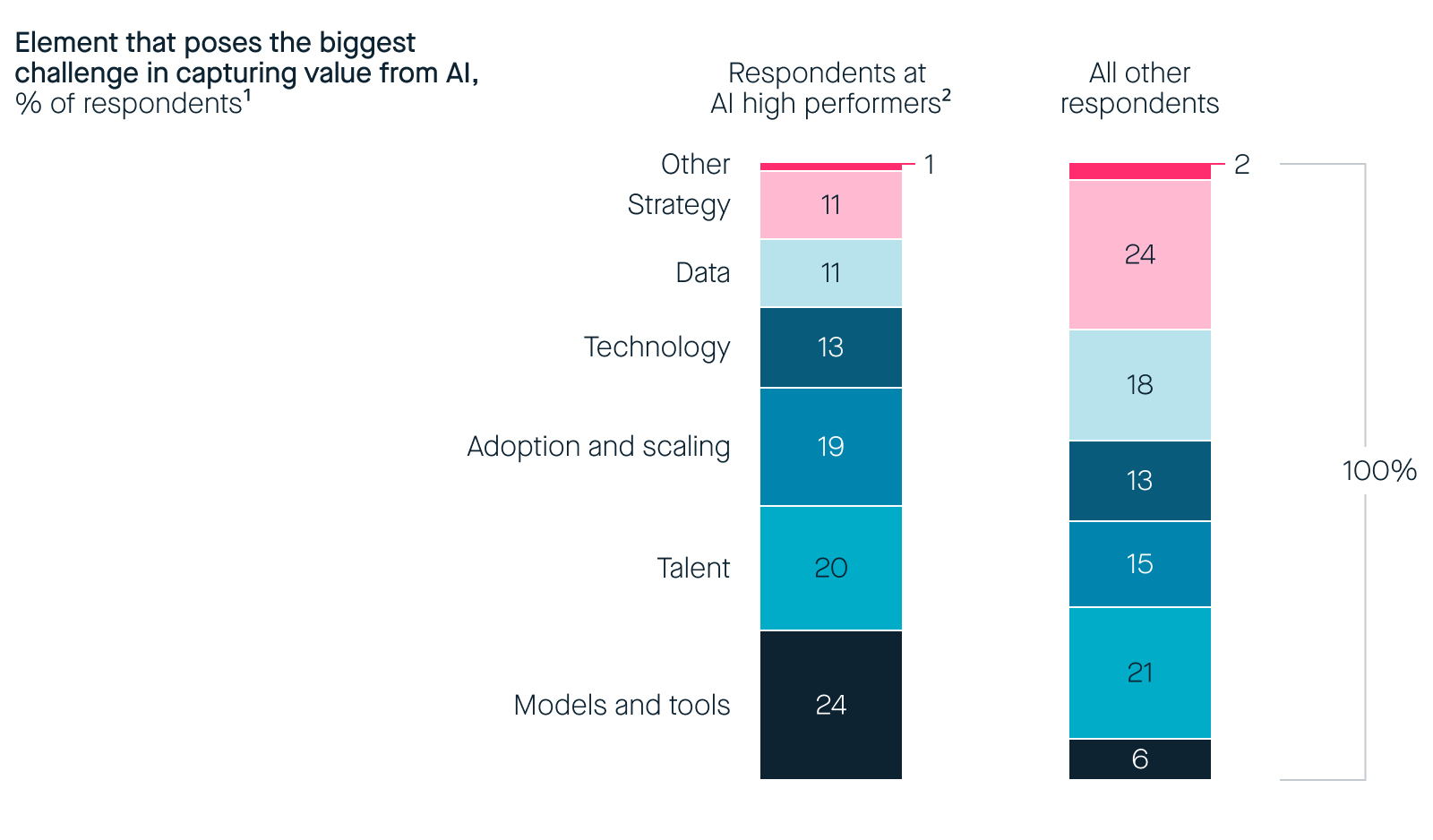

A significant challenge in embracing AI is identifying high-impact use cases with promising returns. Companies in asset finance grapple with determining areas of maximum business impact, ROI, technology readiness, risk reduction, and minimizing disruption to daily operations. According to McKinsey’s The State of AI in 2023 report, most companies identify defining the right strategy and finding the right models and tools as the biggest challenges to their AI adoption (see figure below).

Models and tools pose the biggest AI-related challenge for high performers, while strategy is a common stumbling block for others.

Note: Figures do not sum to 100%, because of rounding.

1Asked only of respodents whose organizations have adopted AI in atleast 1 function.

2Respodents who said that at least 20 percent of their organization's

EBIT in 2022 was the attributable to their use of AI. For respondents at AI High performers, n=49, for all other respondents, n=792.

References:

1. Finextra - Generative AI: The Missing Piece in Financial Services Industry.

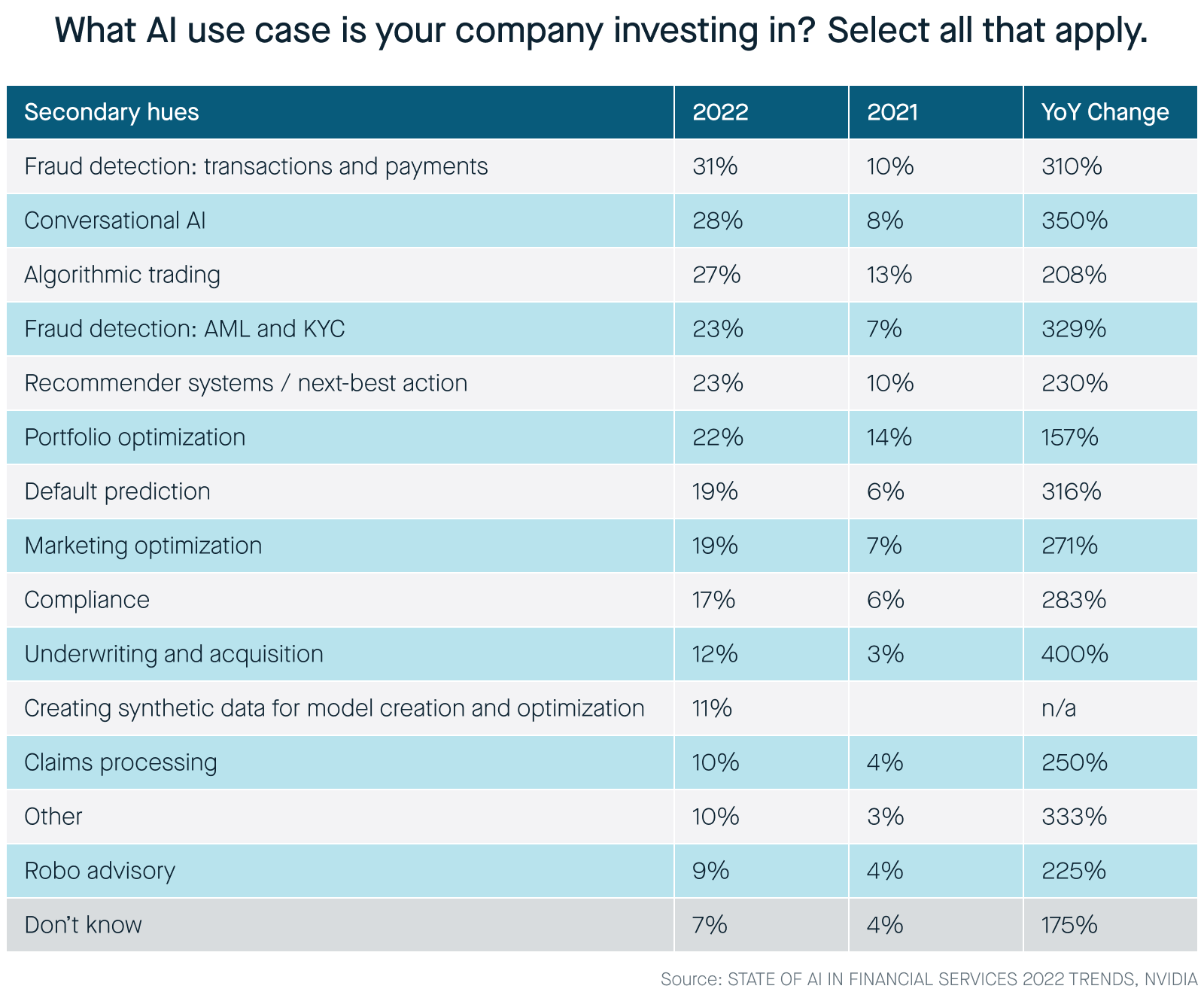

Early projects from various financial institutions provide insights, pinpointing specific areas where AI has already demonstrated a significant impact. These use cases offer calculated risks and are supported by existing technological solutions that have delivered proven results for other financial services organizations. They can help you build a strong and convincing business case for your AI initiative and gain C-suite approval. Mastering these areas sets the stage for pioneering innovative AI applications within organizations

Automation of routine tasks

- Automation of routine tasks: What's remarkable is that automation, often rumored to eliminate jobs, is now eliminating mundane, routine work, so that employees can add more value to the business. From document verification to credit assessments and data entry, intelligent automation streamlines daily business operations, reducing human intervention and minimizing errors. This not only accelerates processes but also ensures greater accuracy, creating a win-win for all stakeholders.

AI-powered automation allows human resources to focus on more strategic, customer-centric aspects of the business. With repetitive tasks handled by AI, employees can dedicate their time to delivering amazing customer experiences, building trust, improving customer loyalty, and boosting morale.

Predictive analytics for risk assessment

- Predictive analytics for risk assessment: AI is transforming traditional, time-intensive processes.

Conventional lending and credit scoring models often rely on historical data and predefined rules. AI introduces a dynamic approach, analyzing not only traditional credit history but also alternative data sources like social media activity.

Leveraging advanced algorithms to analyze vast datasets enables informed predictions about future risks. AI's role involves aggregating diverse data sets and employing machine learning for pattern recognition to identify nuanced indicators of creditworthiness or risk. This ensures continuous learning and adaptation to evolving trends, enhances fraud detection, enables personalized risk assessments, and allows for near real-time decision-making, improving the efficiency of the lending process.

The result is more accurate risk evaluations and faster credit decisioning which in turn leads to faster time-to-funding and approvals.

Fraud detection and prevention

-

Fraud detection and prevention: AI algorithms detect anomalies in financial transactions, identifying potentially fraudulent activities and mitigating risks. Continuous monitoring of financial transactions allows AI systems to pinpoint suspicious behavior and trigger alerts, enabling companies to take immediate action to prevent financial losses.

Banks like Capital One and JPMorgan Chase1 are already using AI-aided fraud detection using generative AI. Both organizations have implemented AI-powered fraud detection system that uses machine learning algorithms to analyze transaction data and identify suspicious activity. The system has been highly successful, reducing false positives by 40% and 75% and improving fraud detection rates by 50% and 8%, for Capital One and JPMorgan respectively. The systems have also reduced the time it takes to investigate and resolve fraud cases, improving customer satisfaction and reducing costs.

In a world where financial fraud is growing in volume and complexity, AI is emerging as a powerful and reliable tool for safeguarding your company’s interest.

Delivering exceptional customer service

- Delivering exceptional customer service: AI is revolutionizing the provisioning of customized offerings through AI-driven analytics that delve into vast sets of customer data and behavior patterns.

AI's capacity to process immense amounts of data and distil meaningful insights facilitates this level of personalization. Large language models (LLMs), machine learning algorithms, and advanced analytics can help companies recommend the most fitting equipment financing options and leasing terms for individual customers.

AI’s ability to understand intricate financial requirements and preferences is revolutionizing customer interactions within the financial services sector. Imagine delighting customers with custom-made offers and product descriptions crafted to align with their specific financial goals and interests. AI extends its transformative influence by generating personalized content that resonates with individual customers, enhancing customer engagement and loyalty.

In essence, AI empowers financial institutions to deliver not only services, but experiences that truly understand and cater to the unique needs of each customer.

Asset maintenance

- Asset maintenance: Predictions are crucial for the asset finance and equipment leasing industry. AI can predict maintenance needs by analyzing usage patterns and sensor data. This proactive approach minimizes downtime and operational costs, ensuring that the equipment stays in optimal condition. The ability to predict maintenance prevents unexpected disruptions and contributes to cost savings.

Real-time portfolio management

- Real-time portfolio management: For companies managing a diversified portfolio of leased assets, real-time monitoring is crucial. AI can assist in monitoring and analyzing network traffic for these assets, ensuring optimal performance, minimizing downtime, and reducing costs associated with equipment breakdowns. The advantages of real-time portfolio management extend beyond cost savings, allowing for improvements to the operational efficiency of asset finance companies.

Preventing cyberattacks

- Preventing cyberattacks: AI plays a crucial role in enhancing security by analyzing and determining normal data patterns and trends and alerting companies to discrepancies or unusual activity. This helps protect customer data and assets from cyber threats.

Striking the balance

Embracing AI for business transformation requires a delicate balance of ambition and caution. Understanding the fundamental questions driving your business goals is paramount. Whether it's expanding portfolios, mitigating risks, seizing revenue opportunities, or cutting operational costs, clarity on priorities is key. Start with a focused use case, allowing room for learning and growth. As AI technology evolves, businesses must adapt, continuously reassessing their strategies. With a practical and purposeful approach, organizations can harness the true potential of AI to enhance their operations and drive sustainable success.

Learn why companies trust Odessa to help deliver great stakeholder experiences.

Let’s Talk